Calculate semi monthly pay after taxes

The calculator is updated with the tax. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

What Are Earnings After Tax Bdc Ca

Ad Web-based PDF Form Filler.

. Reporting Employment Taxes. For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you. It can also be used to help fill steps 3 and 4 of a W-4 form.

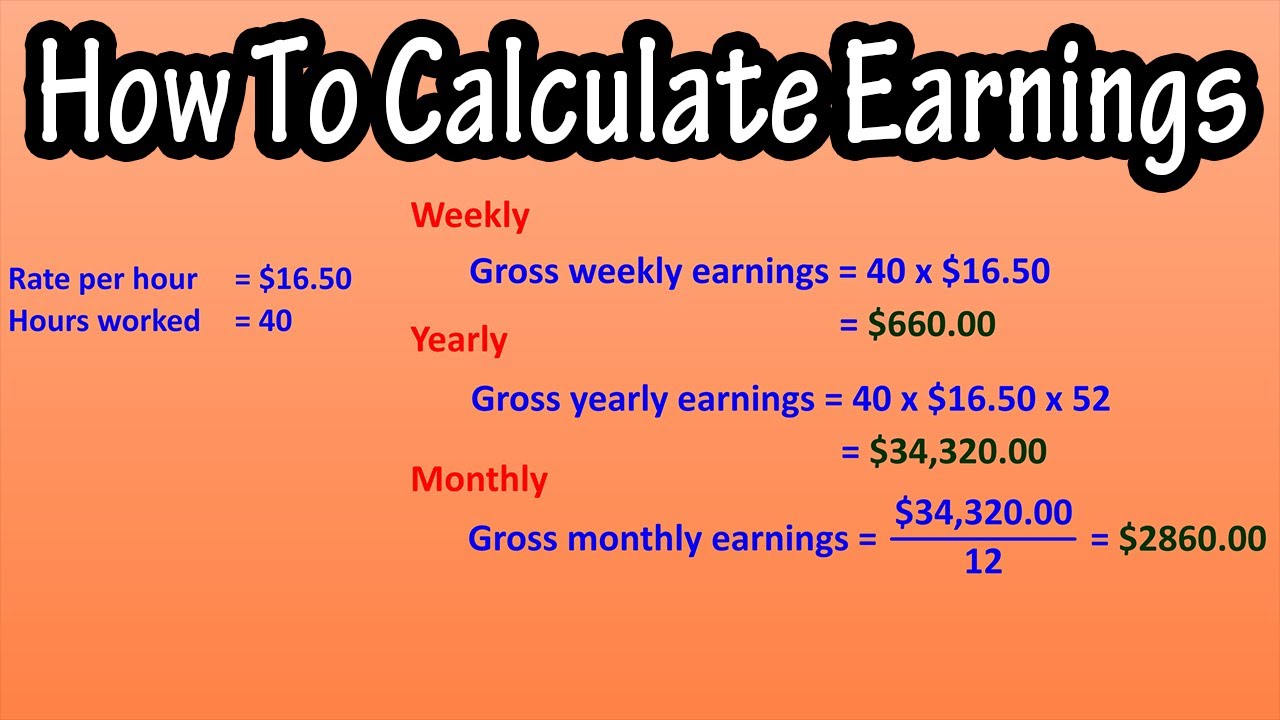

1500 per hour x 40 600 x 52 31200 a year. Generally employers must report wages tips and other compensation paid to an employee by filing the required form s to the IRS. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

That means that your net pay will be 43041 per year or 3587 per month. Our Resources Can Help You Decide Between Taxable Vs. For example if an employee earns 1500 per week the individuals.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of. In a 15-day pay period a semi-monthly gross pay of 2000.

If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month. Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The tax calculator provides a full step by step breakdown and analysis of each.

That means that your net pay will be 37957 per year or 3163 per month. Calculate your paycheck in 5 steps There are five main steps to work out your income tax federal state liability or refunds. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate.

Take-Home Pay in the US Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck. Calculate and Divide Multiply hours worked by your hourly rate.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. First you need to determine your filing status. On Any Device OS.

Your average tax rate is. Usage of the Payroll Calculator. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Your average tax rate is. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Due to the nature of hourly wages the amount paid is variable. If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with. Our online Monthly tax calculator will automatically work out all your deductions based on your Monthly pay.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The adjusted annual salary can be calculated as. For the cashier in our example at the hourly wage.

Youll then see an estimate of. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Ad Discover Helpful Information And Resources On Taxes From AARP.

To determine the new semi-monthly gross pay for a salaried employee who is currently paid bi-weekly either divide his annual income by 24 or undertake the following. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables. Youll then get a breakdown of your total.

Edit Sign and Save Nonres. Give it a Try. You can use the calculator to compare your salaries between 2017 and 2022.

Monthly Income Expense Tracker Work Life Balance Quotes Motivational Quotes For Success Passion Quotes

Avanti Income Tax Calculator

Dominion Blog Payroll Taxes Hr Infographic Payroll

25 Free Budget Printables For Beginners Who Says What Budget Printables Free Budget Printables Free Budget

Salary Pay Stub How To Create A Salary Pay Stub Download This Salary Pay Stub Template Now Templates Salary Business Template

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Paycheck Calculator Take Home Pay Calculator

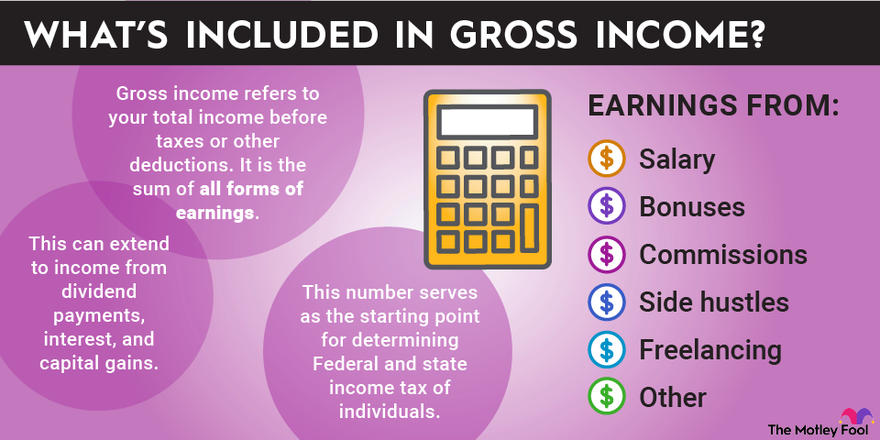

How To Calculate Gross Income Per Month

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Mortgage Calculator Mortgage Calculator Mortgage Amortization Schedule

Biweekly Budget Template Paycheck Budget Budget Printable Etsy Budget Spreadsheet Budgeting Weekly Budget

8 Best Images Of Weekly Budget Worksheet Free Printable Bi Weekly Personal B Budget Template Printable Printable Budget Worksheet Budget Spreadsheet Template

Paycheck Calculator Take Home Pay Calculator

Avanti Gross Salary Calculator

Annual Salary To Semimonthly Paycheck Conversion Calculator